- 分析

- 技術分析

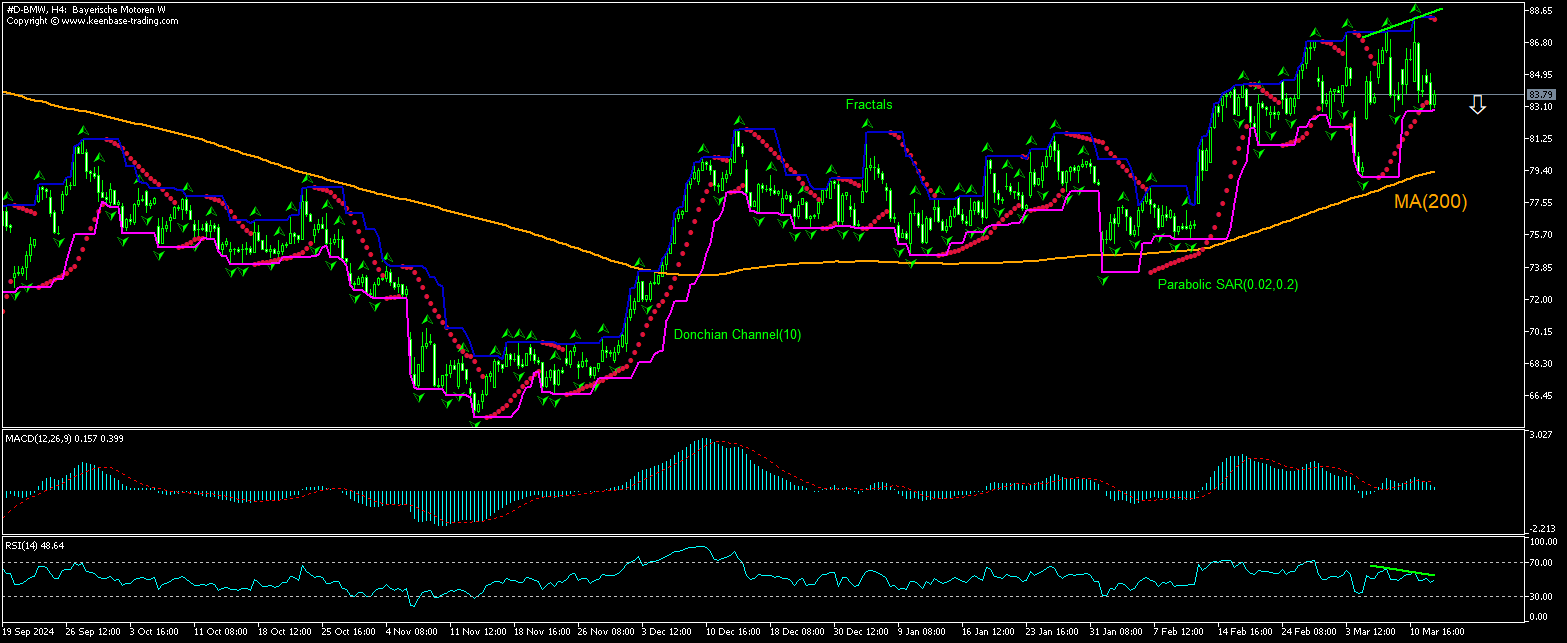

寶馬汽車公司 技術分析 - 寶馬汽車公司 交易: 2025-03-13

寶馬汽車公司 技術分析總結

低於 82.94

Sell Stop

高於 86.4

Stop Loss

| 指標 | 信號 |

| RSI | 賣出 |

| MACD | 賣出 |

| Donchian Channel | 買進 |

| MA(200) | 買進 |

| Fractals | 中和 |

| Parabolic SAR | 賣出 |

寶馬汽車公司 圖表分析

寶馬汽車公司 技術分析

宝马(BMW)股价 4 小时线技术分析图显示,#D-BMW,H4 在两天前反弹至八个月高点后,正向 200 期移动均线 MA(200) 回调。RSI 已形成看跌背离。 我们认为,在价格跌破唐氏通道下边界 82.94 后,看跌势头将持续。该价位可作为挂单卖出的入场点。止损可设在 86.4 以上。下单后,根据抛物线指标信号,每天将止损移至下一个 分形高点。这样,我们就将预期盈亏比改为盈亏平衡点。如果价格达到止损位 (86.4),但未达到订单 (82.94),我们建议取消订单:市场发生了内部变化,而这些变化未被考虑在内。

股票 基本面分析 - 寶馬汽車公司

宝马汽车公司将对美国经销商实行价格保护的消息传出后,股价出现下滑。 宝马股价会反弹吗?

华尔街日报》昨天报道称,宝马汽车公司正告诉美国经销商,至少在未来几周内,它将承担从墨西哥进口的新关税所增加的成本。特朗普关税对欧洲汽车股的影响是负面的。有报道称,宝马公司从墨西哥发运的汽车可能不符合《美国墨西哥和加拿大协定》(USMCA),宝马股价周五下挫达5%。在此之前三天,对从加拿大和墨西哥进口的汽车征收 25% 的关税开始生效。分析人士估计,美国征收的关税可能会使新车和卡车的价格上涨多达1.2万美元。宝马公司表示,它将在5月1日前对某些墨西哥制造的车型(3系轿车和2系双门跑车)实施 “价格保护”,这些车型将被征收关税。这家汽车制造商表示,宝马在美国的销量中约有10%是从墨西哥进口的。美国征收进口关税后,汽车价格上涨,不利于宝马的销售预期和股价。

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.