- 分析

- 技術分析

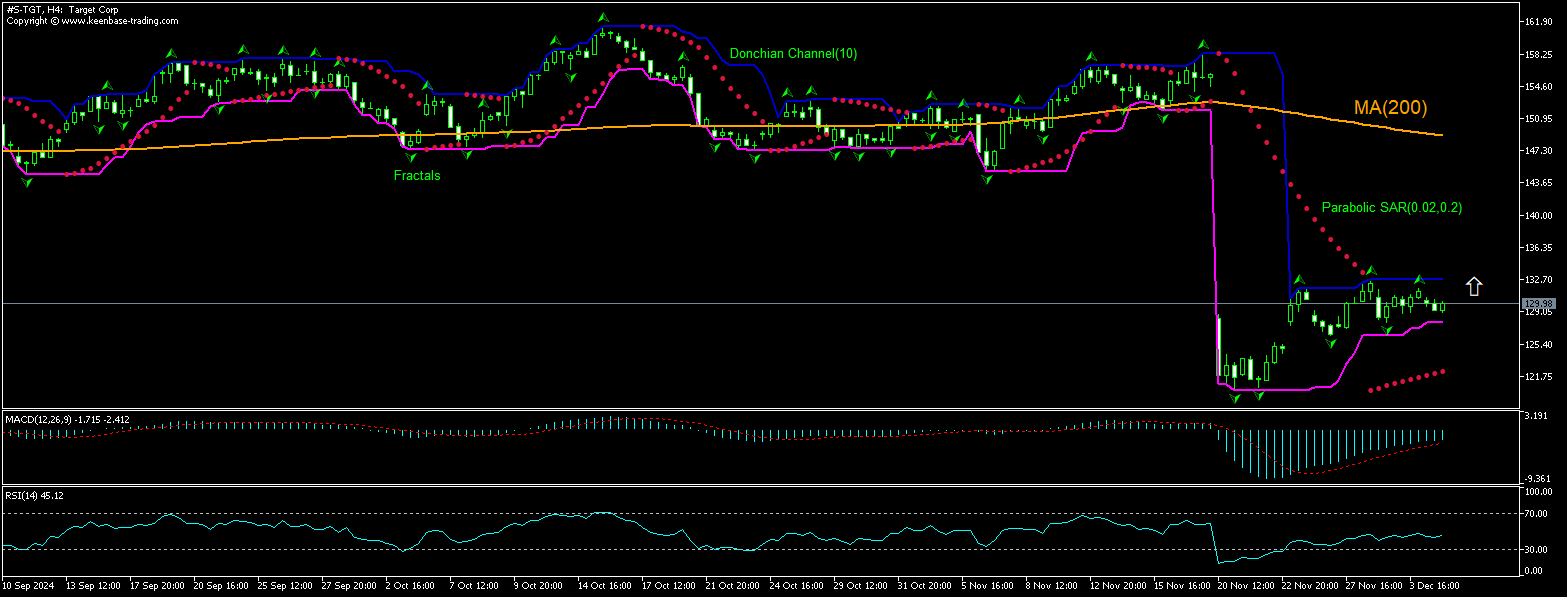

Target Corporation 技術分析 - Target Corporation 交易: 2024-12-05

Target 技術分析總結

高於 132.75

Buy Stop

低於 127.81

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 買進 |

| Donchian Channel | 中和 |

| MA(200) | 賣出 |

| Fractals | 中和 |

| Parabolic SAR | 買進 |

Target 圖表分析

Target 技術分析

4 小时时间框架的目标股价图表的技术分析显示,#S-TGT,H4 在两周前跌破 MA(200) 后,目前在 200 期移动平均线 MA(200) 下方盘整。 我们相信,在价格突破132.75上方donchian边界后,看涨势头将继续。 这个级别可以作为一个入口点放置一个挂单购买. 止损可以放在127.81以下。 下单后,止损将每天移动到下一个分形低点,跟随抛物线指标信号。 因此,我们正在将预期利润/损失比率更改为盈亏平衡点。 如果价格达到止损水平(127.81)而没有达到订单(132.75),我们建议取消订单:市场发生了未考虑的内部变化。

股票 基本面分析 - Target

目标股价昨日收盘走低,此前美国法官裁定该零售商必须面对股东因自豪感反弹而提起的诉讼。 目标股价会恢复回落吗?

塔吉特未能说服佛罗里达州的一名法官驳回一项诉讼,该诉讼指控塔吉特在 “骄傲月 ”销售以 LGBTQ 为主题的商品引发反弹和顾客抵制后欺骗股东。诉讼称,塔吉特董事会只关注激进组织要求采取多元化、公平和包容(DEI)措施的呼声,而忽视了 2023 年 5 月骄傲月活动可能带来的负面影响。该零售商辩称,它已就潜在的多元化、公平和包容(DEI)反弹向投资者发出警告,原告的投诉仅仅是基于对公司商业决策的不同意见。美国地区法官裁定,原告已经提供了足够的信息,因此现在可以起诉塔吉特在防范社会和政治风险方面误导了投资者。预计该公司可能会被勒令支付罚金,而且围绕该诉讼的负面报道对公司股价不利。然而,目前的情况却对塔吉特股价有利。

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.