- 分析

- 技術分析

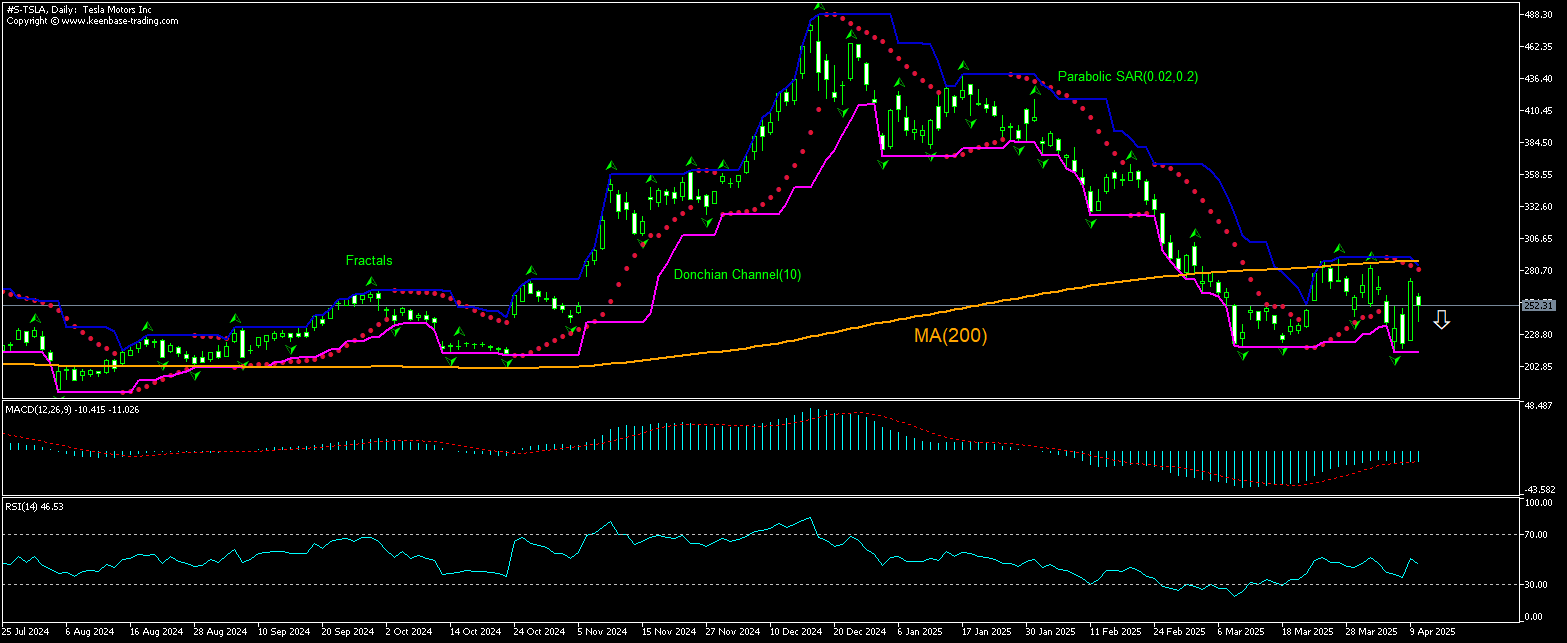

特斯拉汽車公司 技術分析 - 特斯拉汽車公司 交易: 2025-04-11

特斯拉汽車公司 技術分析總結

低於 214.09

Sell Stop

高於 274.38

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 買進 |

| Donchian Channel | 賣出 |

| MA(200) | 賣出 |

| Fractals | 賣出 |

| Parabolic SAR | 賣出 |

特斯拉汽車公司 圖表分析

特斯拉汽車公司 技術分析

The technical analysis of the Tesla stock price chart on daily timeframe shows #S-TSLA,Daily is retracing down after testing the 200-day moving average MA(200). We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 214.09. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed at 274.38. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (274.38) without reaching the order (214.09), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

股票 基本面分析 - 特斯拉汽車公司

Tesla stock is in decline since president Trump ordered steep tariffs on import from Chinas. Will the Tesla stock price continue retreating?

Tesla has suspended taking new orders for two imported models - Model S and Model X vehicles on its Chinese website. Both models are assembled in Tesla’s factories in Fremont, California, and Tilburg, Netherlands, and are exported to China. While no information has been released for the reason for orders suspension, Tesla CEO Elon Musk had recently said that president Trump’s steep tariffs on China - which were hiked to 145% this week- stood to “significantly” impact the EV maker. China is a major market and production hub for Tesla. New orders suspension for Model S and Model X vehicles in China is bearish for Tesla stock price.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.