- 分析

- 交易新聞

- 苹果新闻分析: 蒂姆-库克访华,印度反垄断问题

苹果新闻分析: 蒂姆-库克访华,印度反垄断问题

苹果公司仍然是全球技术领导者,以其创新产品和强大的生态系统而闻名。然而,与其他大公司一样,它也面临着可能影响其股票表现的复杂挑战。

我们将分析最近的事态发展、

- 首席执行官蒂姆-库克在中国的参与、

- 印度的监管挑战、

- 不断演变的产品战略。

我们还将探讨这些因素会如何影响苹果公司的业务和投资者情绪。

苹果关键新闻事件

- 蒂姆-库克访华

蒂姆-库克最近出席了在北京举行的中国国际供应链博览会,强调了中国在苹果供应链和市场战略中的关键作用。他在讲话中强调,没有中国就不可能有苹果公司的成就,这可能是为了在 iPhone 销售放缓和华为等本土品牌竞争加剧的情况下加强与中国的联系。

库克的积极言论导致 AAC Technologies 和舜宇光学等苹果供应商的股价飙升,反映了市场对该公司继续依赖中国的信心。不过,苹果仍面临挑战,包括该地区消费支出疲软以及美国法规对人工智能技术出口的限制。

- 印度的反垄断挑战

在印度,印度竞争委员会(CCI)指控苹果利用其在应用商店市场的主导地位损害了开发者和支付处理商的利益。正在进行的调查可能会导致罚款,监管机构要求苹果公司提供近几年经审计的财务报表。

虽然苹果公司否认了这些指控,辩称自己在印度以安卓系统为主的智能手机市场上只是一个小角色,但这种审查可能会阻碍其在全球增长最快的经济体之一的发展雄心。

分析师对苹果产品战略的见解

分析师马克-古尔曼(Mark Gurman)最近指出,投资者不应该期待苹果公司再推出像 iPhone 这样的突破性产品,因为 iPhone 创造了苹果公司一半以上的收入。相反,苹果正专注于较小的、高增长的领域,如混合和增强现实技术、健康产品和智能家居技术。

即将推出的新产品包括 2025 年推出的智能家居显示器,以及 2026 年进入智能家居 IP 摄像头市场。

这些新的产品类别有望与苹果的生态系统无缝整合,在丰富其产品组合的同时,提供前景广阔的收入来源。

苹果股价分析

- 短期分析

库克访华增强了人们对苹果供应链稳定性的信心,可能在短期内支撑其股价。不过,iPhone 在中国的销量下滑和印度的监管压力等挑战可能会造成短期障碍。

- 中长期

苹果公司转向多元化收入来源,表明其减少对 iPhone 依赖的战略转变。它在健康订阅、智能家居产品和人工智能驱动功能方面的投资,可能会带来巨大的增长机会。

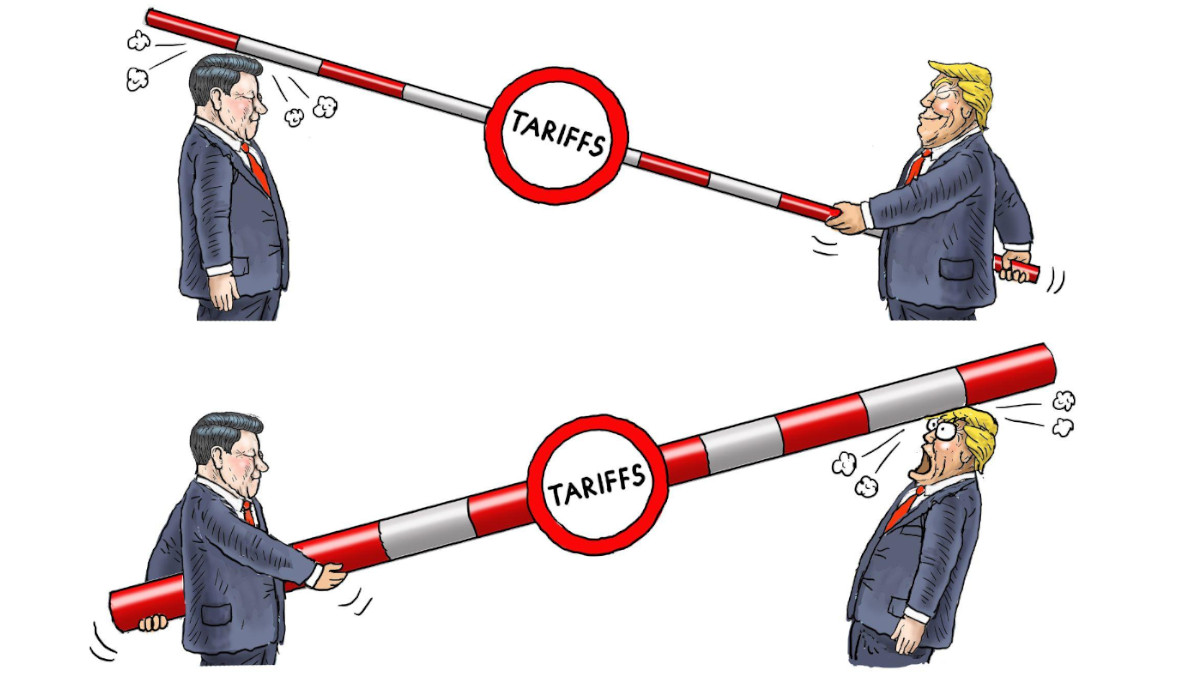

包括中美紧张局势和印度反垄断审查在内的风险依然令人担忧。

市场情绪和分析师预期

苹果公司稳定的利润增长给了投资者信心。分析师预测,规模较小、盈利能力较强的企业可以抵消传统收入来源可能出现的下滑,从而支撑公司的股票估值。